MARCH 26, 2020

PRADHAN MANTRI GARIB KALYAN YOJANA: 1.7 LAKH CRORE,(0.85% OF GDP)

■ Front-loading of PM Kisan funds:

17,380 crore

17,380 crore

■ Building and Other Construction

Workers Welfare

Workers Welfare

Cess Fund: `31,000 crore

■ District Mineral Foundation Funds: 35,925 crore

ADDITIONAL FISCALCOST: 85,695 Cr.(0.43% of GDP)

MARCH 27, 2020

LIQUIDITY INJECTION BY RBI :3.74 LAKH CR (1.8% of GDP)

■Targeted Long-Term Repo Operations (TLTRO)

: 1,00,000 crore

: 1,00,000 crore

■ CRR cut by 100 basis points to 3%: 1,37,000 crore

■ Accommodation under Marginal Standing Facility hiked from 2% of SLR to 3%: 1,37,000 cr.

APRIL 17, 2020

LIQUIDITY INJECTION BY THE RBI SIZE: 0.5% of GDP

■ TLTRO 2.0: 50,000 crore

■ Refinance of Sidbi, Nabard and NHB: 50,000 crore

APRIL 27, 2020

SPECIAL LIQUIDITY FACILITY FOR MFs:50,000 Cr.

(25% OF GDP)

(25% OF GDP)

MAY 12, 2020

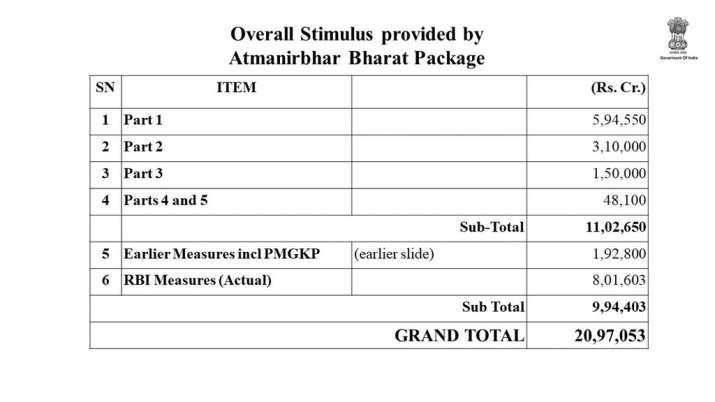

PM Narendra Modi announces ` 20 lakh crore

AtmaNirbhar package, says size is 10% of GDP,

including announcements made by RBI and FM earlier

MAY 13, 2020

TRANCHE 1 OF ATMANIRBHAR PACKAGE: 5.94 LAKH Cr (2.97% of GDP)

■ Collateral free automatic loans to MSMEs, 100%

core guarantee cover to banks, NBFCs: 3 lakh crore

■ Subordinate debt to stressed MSMEs: 20,000 crore

■ Equity infusion for MSMEs: 50,000 cr.

■ EPF support for 3 months: 2,500 cr.

■ EPF contribution reduced for 3 month: 6,750 cr.

■ Liquidity scheme for NBFCs/ HFCs/ MFIs: 30,000 cr.

■ Partial Credit Guarantee Scheme 2.0 for NBFC

first 20% loss borne by govt: 45,000 cr.

first 20% loss borne by govt: 45,000 cr.

■ Liquidity injection by REC and PFC: 90,000 cr.

■ 25% reduction in TDS/TCS rate: 50,000 cr.

MAY 14, 2020

SIZE: 3.10 LAKH CR. (1.55% OF GDP)

■ Free food grain supply to migrants for 2 mths: 3,500 cr

■ Interest subvention of 2% for prompt-payees of Mudra- Shishu loans: 1,500 crore

■ Special liquidity scheme to provide 10,000 working

capital to 50 lakh street vendors: 5,000 cr.

capital to 50 lakh street vendors: 5,000 cr.

■ Credit-linked subsidy scheme for middle income

families (6-18 lakh a year)

families (6-18 lakh a year)

■ Additional emergency working capital for farmers

through NABARD: 30,000 cr

through NABARD: 30,000 cr

■ Concessional credit to 2.5 crore farmers through Kisan Credit Cards: 2 lakh crore

MAY 15, 2020

SIZE: ` 1.5 LAKH CR (0.75% OF GDP)

■ Financing facility for agri infra projects: 1,00,000 cr

■ Scheme for formalisation of Micro Food Enterprises

:10,000 crore

:10,000 crore

■ Funding for fishermen: 20,000 crore

■ Animal Husbandry Infrastructure Development Fund be

set up: 15,000 cr

set up: 15,000 cr

■ Essential Commodities Act to be to

amended “deregulate” agricultural foodstuffs and

allow clamping of stock limits on these only under “very

exceptional circumstances”

amended “deregulate” agricultural foodstuffs and

allow clamping of stock limits on these only under “very

exceptional circumstances”

■ Formulation of a central law that will not bind farmers to

sell crop only to licensed traders in the

APMC (Agricultural Produce Market Committee)

mandis : 30,000 Cr(0.15% OF GDP)

sell crop only to licensed traders in the

APMC (Agricultural Produce Market Committee)

mandis : 30,000 Cr(0.15% OF GDP)

MAY 16, 2020

SIZE: 8,100 CRORE (0.04% OF GDP)

■ Defence FDI hiked to 74% from 49%

■ Viability gap funding (VGP) for social infrastructure:

8,100 CRORE VGP (0.04% OF GDP)

8,100 CRORE VGP (0.04% OF GDP)

MAY 17, 2020

■ Limit of state borrowings increased to 5% from 3%

of GSDP

of GSDP

■ MGNREGA gets additional `40,000 cr: 40,000 Cr

(0.2% of GDP)

(0.2% of GDP)

No comments:

Post a Comment